New Webinar Sessions For 2025!

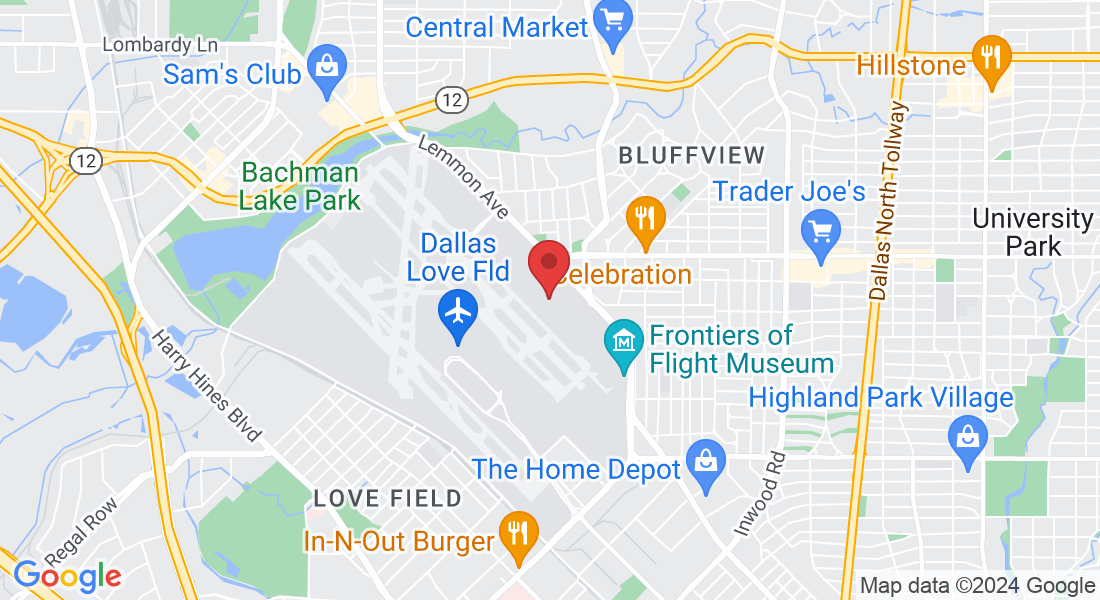

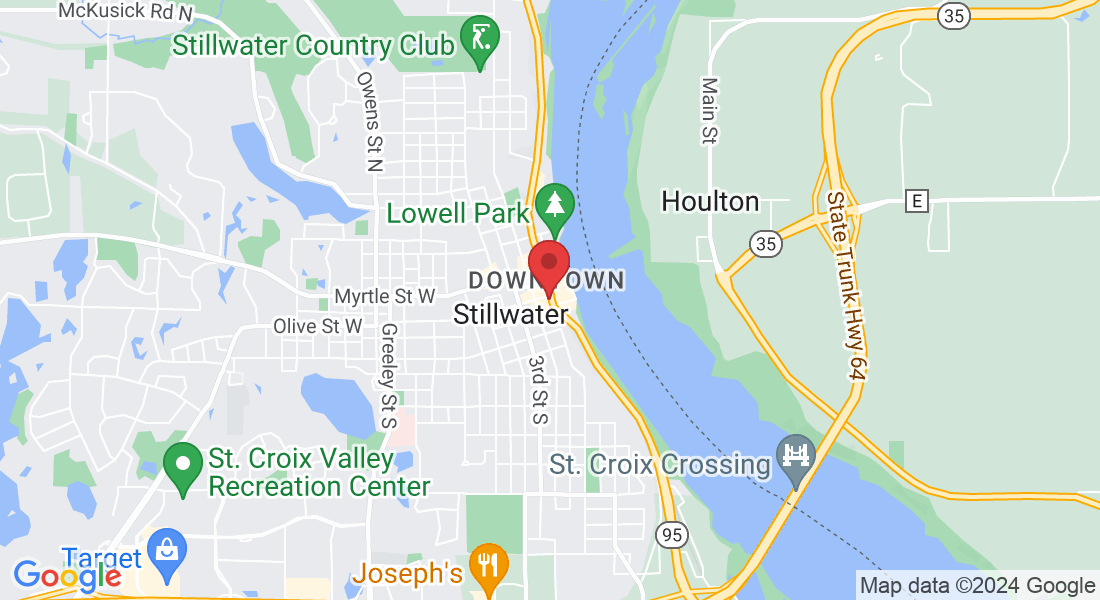

Don't miss out on our new and improved webinars for 2025. Learn about getting a detailed college cost estimate and how colleges determine who gets financial aid. Learn about how you can spend less of your money and get a quality education for your student!

Secure your Child's college future today!

Plan ahead to afford college without sacrificing your financial security.

Don't let rising tuition costs or financial uncertainty prevent your child from achieving their dreams. Our personalized financial planning solutions help you navigate the complexities of college funding, ensuring your child’s success without compromising your own.

Worried About College Costs?

You’re not alone—many parents face this challenge.

As a parent, you want to support your child’s education without jeopardizing your financial future. The rising costs of college can be daunting, but with the right plan, you can navigate these challenges and achieve peace of mind.

Expert Guidance Every Step of the Way

We understand your concerns and have the experience to help.

With years of experience in college financial planning, we provide expert advice tailored to your unique situation. Our goal is to help you support your child’s education while securing your financial future.

A Clear Path to Financial Security

Three steps to ensure your child’s future.

Personalized Financial Analysis: We evaluate your current financial situation and future goals.

Actionable Strategy: We develop a customized plan that includes saving, financial aid, and low-risk funding options.

Ongoing Support: We monitor your progress and adjust the plan as needed to ensure your goals are met.

Avoid Debt And Financial Strain

Without a plan, you risk your child’s future and your own.

Failing to plan for college expenses can lead to overwhelming debt, missed financial aid opportunities, and long-term financial strain. Don’t let these risks become your reality—take control with our expert guidance.

Graduate Debt-Free and Stress-Free

Secure your child’s education and your financial peace of mind.

Imagine your child graduating without the burden of debt while you enjoy the satisfaction of knowing you’ve secured both their future and your own financial stability. Our planning solutions make this dream a reality.

FAQS

When should we start the college planning process?

It's never too early to start college planning! Ideally, it is recommended to begin the process in the early years of high school, around the freshman or sophomore year. This allows ample time to research colleges, understand admission requirements, and plan your child's academic trajectory accordingly. However, even if your child is in their junior or senior year, it's never too late to start. We can help you catch up and make the most of the time available

What types of financial aid are available?

There are various types of financial aid available to students, including scholarships, grants, work-study programs, and loans. Scholarships are typically awarded based on merit or specific criteria, while grants are often need-based and do not require repayment. Work-study programs provide part-time employment opportunities on campus, and loans need to be repaid over time with interest. Our experts will guide you through the process, helping you understand the differences and explore the options that best suit your financial situation.

How can we find out about scholarships?

There are several ways to find out about available merit-based scholarships. Start by researching scholarship databases, both online and offline, which list various scholarship opportunities based on different criteria. Additionally, reach out to your child's high school guidance counselor, who can provide information about local or school-specific scholarships. Explore professional organizations, community groups, and corporations that offer scholarships related to your child's interests or field of study. Our experts will guide you through this process, ensuring you don't miss any potential scholarship opportunities.